Mortgage Broker Glendale CA: Tailored Solutions for Novice Homebuyers

Mortgage Broker Glendale CA: Tailored Solutions for Novice Homebuyers

Blog Article

The Advantages of Involving a Home Loan Broker for First-Time Homebuyers Seeking Tailored Funding Solutions and Professional Support

For new buyers, navigating the intricacies of the mortgage landscape can be complicated, which is where involving a home loan broker shows indispensable. Brokers offer individualized financing options customized to specific economic situations, while likewise giving expert guidance throughout the entire process.

Comprehending Mortgage Brokers

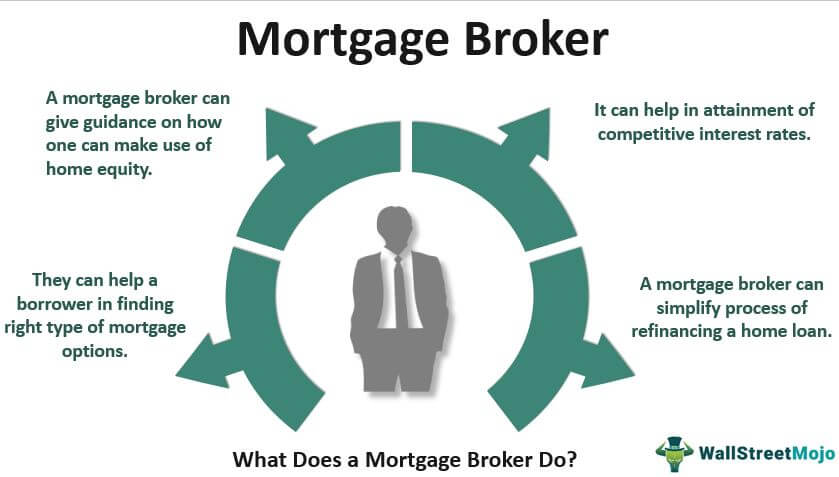

A home loan broker serves as an intermediary between debtors and lending institutions, promoting the financing application procedure for buyers. They have knowledge in the home loan market and are well-versed in various lending items available. This expertise allows them to guide new buyers via the typically intricate landscape of home mortgage choices.

Generally, home loan brokers function with a range of lenders, enabling them to present numerous funding services tailored to the specific requirements of their clients. Their function includes assessing a borrower's monetary circumstance, creditworthiness, and homeownership goals to match them with ideal lending institutions. This not only saves time but also boosts the probability of protecting favorable lending terms.

Additionally, mortgage brokers manage the paperwork and communicate with loan providers in behalf of the borrower, improving the procedure and relieving a few of the stress and anxiety connected with acquiring a home loan. They likewise remain upgraded on industry fads and governing modifications, ensuring that clients receive accurate and prompt advice. By leveraging their connections with lending institutions, mortgage brokers can commonly discuss far better prices and terms than individuals might safeguard on their own, making their solutions very useful for first-time buyers navigating the home loan procedure.

Personalized Funding Solutions

Customized funding remedies are crucial for first-time buyers looking for to navigate the complexities of the home loan landscape. Each homebuyer's financial situation is special, including differing credit rating, income levels, and personal financial goals. Engaging a home loan broker permits buyers to accessibility tailored funding options that straighten with their certain needs, making sure a more efficient home mortgage experience.

Home loan brokers have accessibility to a large range of loan providers and mortgage items, which allows them to present tailored selections that might not be offered through standard financial institutions. They can evaluate a buyer's monetary profile and suggest suitable car loan programs, such as standard lendings, FHA car loans, or VA fundings, depending upon the individual's certifications and objectives.

Additionally, brokers can work out terms with lenders on behalf of the property buyer, possibly safeguarding better passion rates and lower costs. This customized method not only improves the possibilities of finance authorization yet also offers tranquility of mind, as newbie buyers typically really feel bewildered by the decision-making procedure.

Eventually, customized funding services supplied by home mortgage brokers equip newbie buyers to make informed choices, leading the way toward effective homeownership customized to their economic situations. Mortgage Broker Glendale CA.

Professional Guidance Throughout the Process

Specialist assistance throughout the home loan procedure is important for newbie homebuyers, who may find the intricacies of protecting a loan intimidating. A mortgage broker acts as a crucial resource, using know-how that assists navigate the myriad of needs and choices involved. From the preliminary examination to closing, brokers give quality on each step, ensuring that property buyers recognize their options and effects.

Home loan brokers streamline the application process by helping with paperwork and paperwork, which can frequently be frustrating for amateurs. They aid identify possible risks, enlightening customers on typical blunders to prevent, and making sure that all necessary info is accurately presented to lending institutions. This aggressive technique not only simplifies the process but additionally improves the likelihood of safeguarding beneficial car loan terms.

Accessibility to Numerous Lenders

Accessibility to numerous loan providers is a substantial benefit for first-time buyers collaborating with a mortgage broker. Unlike conventional financial institutions, which might supply a limited variety of home loan products, a mortgage broker has accessibility to a diverse network of loan providers, including local banks, debt unions, and national establishments. This wide gain access to enables brokers to present a selection of funding alternatives customized to the special economic scenarios and choices of their clients.

By assessing multiple lending institutions simultaneously, homebuyers i thought about this can gain from competitive rate of interest and differed car loan terms (Mortgage Broker Glendale CA). This not only enhances the likelihood of safeguarding a home loan that fits their budget yet likewise provides the chance to contrast different products, guaranteeing educated decision-making. In addition, a home loan broker can identify specific niche lenders who might supply specific programs for first-time purchasers, such as reduced deposit choices or grants

In addition, having accessibility to several loan providers boosts negotiation power. Brokers can leverage offers and terms from one loan provider against another, possibly bring about better financing setups. This level of gain access to ultimately encourages new property buyers, supplying them with the tools required to browse the complexities of the mortgage market with confidence.

Time and Expense Efficiency

Dealing with a home mortgage broker not just offers accessibility to several loan providers but likewise dramatically enhances time and expense performance for novice property buyers (Mortgage Broker Glendale CA). Browsing the complex landscape of home mortgage alternatives can be discouraging; however, brokers enhance this procedure by leveraging their industry experience and well established connections with lending institutions. This permits them to swiftly identify ideal visit homepage finance items customized to the buyer's financial circumstance and goals

Moreover, home loan brokers save clients important time by managing the laborious paperwork and communication associated with the mortgage application procedure. They guarantee that all documents is total and accurate before entry, lowering the probability of delays brought on by missing information. This positive approach expedites approval timelines, enabling purchasers to secure funding more swiftly than if they were to browse the procedure individually.

Conclusion

Involving a home loan broker gives first-time buyers with vital advantages in navigating the facility landscape of home funding. By enhancing the mortgage procedure and leveraging relationships with multiple lending institutions, brokers enhance both performance and cost-effectiveness.

For new property buyers, navigating the complexities of the home loan landscape can be difficult, which is where engaging a home loan broker confirms indispensable.Additionally, home mortgage brokers manage the paperwork and interact with lending institutions on part of the debtor, improving the procedure and easing some of the stress and anxiety connected with obtaining a home loan. By leveraging their partnerships with lenders, mortgage brokers can frequently discuss far better rates and terms than individuals may secure on their very own, making their services vital for novice property buyers navigating the mortgage procedure.

Ultimately, involving a home loan broker makes sure that buyers obtain tailored assistance, aiding to debunk the home mortgage procedure and lead them towards successful homeownership.

Unlike traditional financial institutions, which might use a limited array of home loan products, a home mortgage broker has accessibility to a diverse network of lenders, consisting of neighborhood financial institutions, credit scores unions, and nationwide organizations.

Report this page